how much federal taxes deducted from paycheck nc

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. How to calculate Federal Tax based on your Weekly Income.

This state tax FICA taxes and federal income tax are deducted from a North.

. Your employer then will multiply 68076 by 15 percent 10211 and add the 1680 base amount. 9 rows Brief summary. 10 on the first 9700 970 12 on the next 29774 357288 22 on the.

A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. Estimate your federal income tax withholding. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. For Tax Years 2015 and 2016 the North Carolina individual income tax rate.

See how your refund take-home pay or tax due are affected by withholding amount. Plus to make things even breezier. Fast easy accurate payroll and tax so you save.

The federal withholding tax rate an employee owes depends on. Deductions for the employers benefit are limited as follows. 15 hours agoThe White House has said the value of that forgiveness up to 10000 for some and to 20000 for others is exempt from federal income tax.

Federal income tax and FICA tax. Paycheck Deductions for 1000 Paycheck. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is 5499 005499.

The income tax is a flat rate of 499. How much tax is deducted from a 1000 paycheck. Take Your 2019 Standard Deduction North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were.

The withholding tables have tax. Use this tool to. Your employer pays another 62 percent on your behalf.

Plus to make things even breezier. There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. This can make filing.

Overview of North Carolina Taxes. For 2022 employees will pay 62 in Social Security on the. For Medicare you both pay.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions. How It Works. Employers must withhold this tax on employees who earn 200000 or more.

Physical Address 3512 Bush Street Raleigh NC 27609 Map It. Gross Pay Federal Income Tax. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

The federal income tax has seven tax rates for 2020. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. For example in the tax.

A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage. How Your Paycheck Works. It is 525 and must be paid by any resident or non-resident who generates money in the USA.

These amounts are paid by both employees and employers. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500. Plus to make things even breezier.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. No state-level payroll tax. Mailing Address 1410 Mail Service Center Raleigh NC 27699-1410.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. Some employees will have to pay the 09 Additional Medicare Tax depending on their income and filing status. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted.

FICA taxes consist of Social Security and Medicare taxes.

Order Your Lost Or Damage Payslips Online P60 Have You Lost Your Proof Of Income Then Don T Worry Get Orde National Insurance Number Number Words End Of Year

Payroll Software Solution For North Carolina Small Business

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Income Tax Calculator Smartasset

Personal Finance Planner Template Inspirational Free Personal Bud Template 9 Free Budget Planner Template Personal Budget Template Financial Budget Spreadsheet

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Income Tax Calculator Smartasset

Irs Installment Agreement North Carolina Mm Financial Consulting Tax Debt Debt Help Payroll Taxes

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

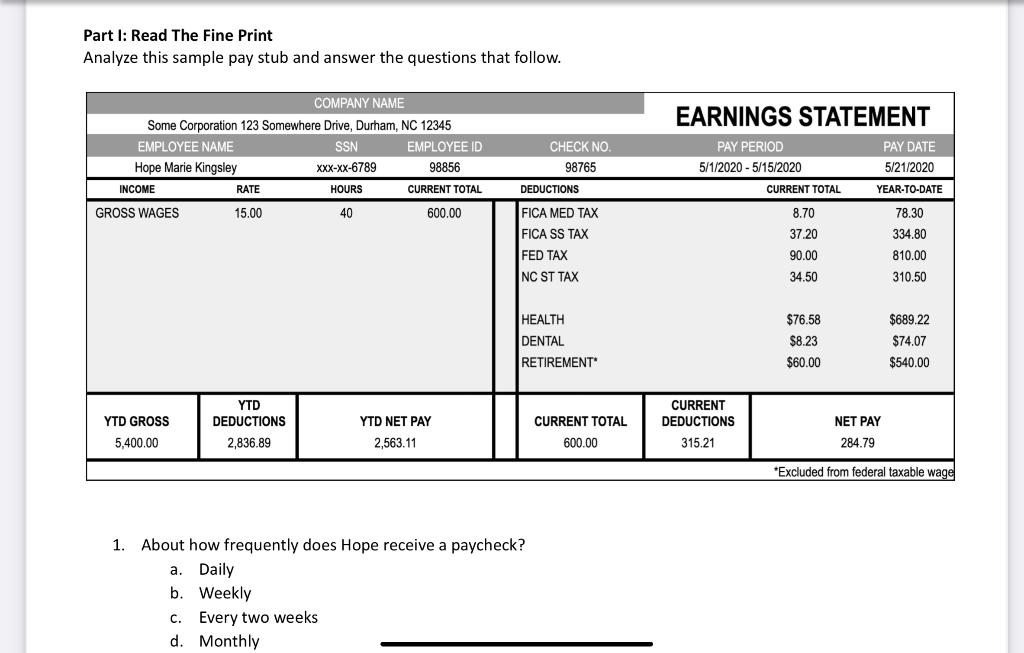

Solved Part I Read The Fine Print Analyze This Sample Pay Chegg Com

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation